“Thanks to your visionary support, Western is delivering the talent, knowledge and leadership to build a healthier and more prosperous future. ”

Financial Highlights

Fiscal 2025

$1.4

billion

Total endowment

$47

million

Expenditures

9.4%

Investment

return

40%

Student

awards

38%

Chairs &

professorships

5%

Research

17%

Academic

enrichment

“Receiving an award eased my financial burden and empowered me to continue my work in promoting health equity and Indigenous cultural preservation. I am committed to giving back and helping future students. ”

Responsible Investing at Western

Western is committed to responsible investing with a goal of long-term, sustained, decarbonization in its Operating & Endowment Fund, aimed at net zero by 2050, or sooner.

This pursuit reflects the coordinated efforts of a research-intensive university seeking to contribute solutions to climate change, with responsible investing being one of the many ways we are holding ourselves accountable.

Western takes that lens to its investing practices, and since 2022, the Responsible Investing Strategy and Pathway has set out specific goals. These include investing 10 per cent of the Operating and Endowment Fund in sustainable investment strategies by 2025 and reducing carbon intensity by at least 45 per cent by 2030.

The path forward will not be measured in quarters, but in years and decades for supporting the enduring mission of the university.

“Philanthropic support enables me to devote greater focus to advancing research in the mechanisms of aging and cognitive and motor disability, improving quality of life for older adults and mentoring emerging scientists.”

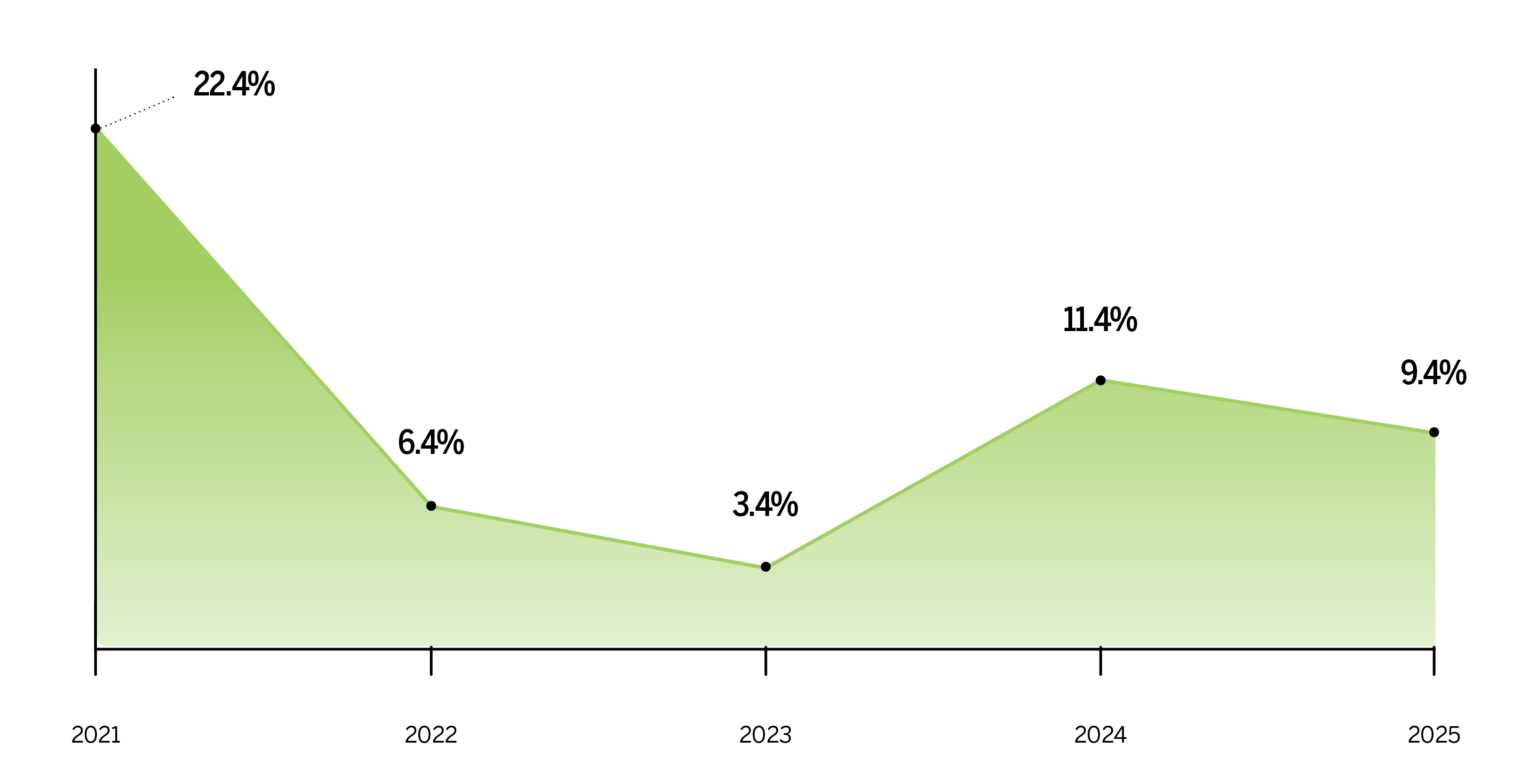

Investment Returns Over Five Years

Investment payout rates and timing

The total return earned by the endowment portfolio net of investment management costs is allocated proportionately to the capital of each endowment fund at April 30 each year. For the period May 1, 2024 to April 30, 2025 the investment return, net of investment management costs of approximately 1.1 per cent, was 9.4 per cent.

An amount equal to 4.0 per cent of the ending capital averaged over the five most recent years is allocated for expenditure each year. The five-year average is used to level the effect of market fluctuations. The allocation for expenditure is reflected as a transfer from the capital account to the expendable account on your fund report. In the case of new endowments, the average will be calculated based upon the number of years the endowment has been at Western.

Understanding Your Fund Report

2024-2025 Allocation for Expenditure: Amount allocated from the capital account to the expendable account for spending in the next fiscal year. This allocation is made to the endowment at the beginning of each fiscal year. It is calculated at 4.0 per cent of the ending capital balances averaged over the five most recent years. In the case of new endowments, the average will be calculated based upon the numbers of years the endowment has been at Western.

Beginning Balance: Value at the beginning of the fiscal year. This amount is brought forward from the prior fiscal year.

Capital Account: Portion of the endowment invested to earn income. Unless otherwise directed, donations are deposited into the capital account.

Ending Balance: Value at the end of the fiscal year. This amount will be carried forward to the next fiscal year.

Expendable Account: Portion of the endowment available to fund its stated purpose. If directed, donations can be deposited into the expendable account.

Expenditures: Funds spent to support the stated purpose of the endowment. These expenditures carry out donor intent.

Investment Income (Loss): Investment return for the fiscal year net of investment management costs.

Interest on Expendable Account Balance: Interest income on funds in the expendable account based on the 30-day Canada T-Bill rate, net of costs.

New Donations: Contributions received from donors during the fiscal year.

Transfers: Includes transfers to/from other funds (if any).